“Discover the top budgeting apps to manage finances and boost your financial health. Explore expense tracking, savings goals, and more. Start your journey to financial success today”.

In today’s fast-paced world, managing your finances has become more critical than ever. Thankfully, technology has made this task easier than ever before with a wide range of budgeting apps at your disposal. Whether you’re looking to save money, pay off debt, or just gain a better understanding of your financial situation, there’s a budgeting app out there to meet your needs. In this article, we’ll explore the top budgeting apps that can help you take control of your finances.

Top 15 Budgeting Apps

Before diving into our list of the best budgeting apps, let’s briefly discuss why these apps are essential for anyone looking to improve their financial health. Budgeting apps offer several advantages:

1. Simplified Expense Tracking

With budgeting apps, you can effortlessly track your expenses by categorizing them. This enables you to see exactly where your money is going each month, making it easier to identify areas where you can cut back.

2. Goal Setting and Tracking

Most budgeting apps allow you to set financial goals, whether it’s saving for a vacation, paying off a loan, or building an emergency fund. These apps then help you track your progress, motivating you to stay on target.

3. Real-Time Financial Insights

Budgeting apps provide real-time insights into your financial situation. You can check your account balances, monitor upcoming bills, and get a snapshot of your net worth at any given moment.

4. Improved Financial Discipline

By actively managing your finances through a budgeting app, you’ll develop better financial discipline. It’s easier to resist unnecessary expenses when you have a clear budget in place.

Top 15 Budgeting apps

- Mint

- YNAB (You Need A Budget)

- PocketGuard

- Personal capita;

- Everydollar

- Goodbudget

- Wally

- Clarity Money

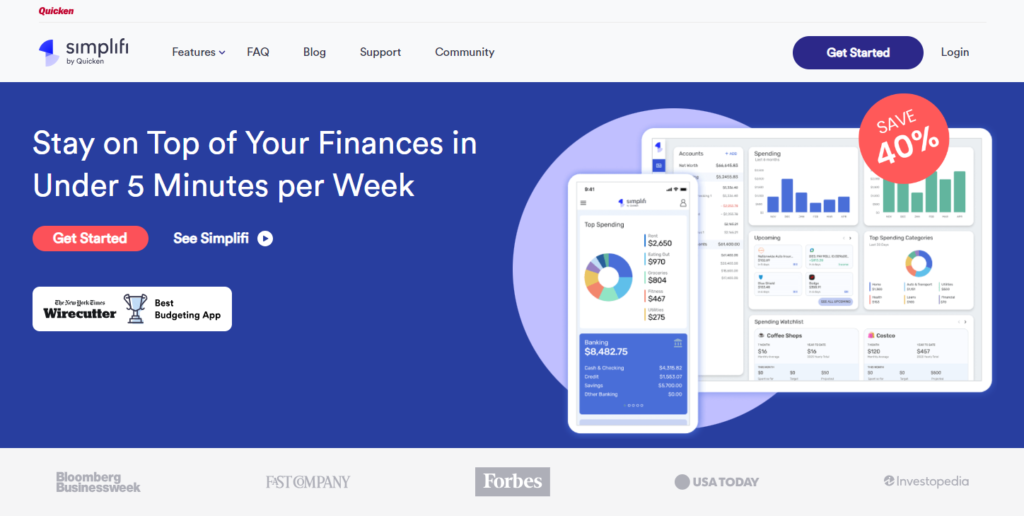

- Simplifi by Quicken

- Honeydue

- Wallet

- Expensify

- BudgetBakers

- Dollarbird

- Banktivity

Here’s a small table summarizing the top 5 budgeting apps for you from our list:

| Rank | Budgeting App | Description |

| 1 | Mint | Comprehensive suite of financial tools, expense tracking, budget creation, and personalized financial advice. |

| 2 | YNAB | Focuses on giving every dollar a job, offers educational resources, and live workshops for financial literacy. |

| 3 | PocketGuard | Simplifies budgeting with a clear overview of your financial situation, tracks income, expenses, and upcoming bills. |

| 4 | Personal Capital | Combines budgeting with investment tracking, provides a holistic financial dashboard, and net worth calculation. |

| 5 | EveryDollar | Follows a zero-based budgeting approach, offers financial coaching, and personalized advice by Dave Ramsey. |

Now that we’ve highlighted the importance of budgeting apps, let’s explore the top choices available.

Mint is a well-established budgeting app that offers a comprehensive suite of financial tools. It connects to your bank accounts, credit cards, and investments, providing a holistic view of your finances. Mint categorizes your transactions, tracks your spending, and sends alerts for upcoming bills. With Mint, you can create a budget tailored to your financial goals and receive personalized financial advice.

YNAB is a popular budgeting app that focuses on the principle of giving every dollar a job. It helps you prioritize your spending, allocate funds to different categories, and stay accountable to your financial goals. YNAB offers educational resources and live workshops to improve your financial literacy, making it an excellent choice for those looking to build long-term financial habits.

PocketGuard simplifies budgeting by providing a clear overview of your financial situation. It tracks your income and expenses, identifies potential savings, and even factors in upcoming bills. With its user-friendly interface, PocketGuard is an excellent choice for beginners.

4. Personal Capital

Personal Capital combines budgeting with investment tracking. It offers a comprehensive financial dashboard, allowing you to see your cash flow, net worth, and investment performance in one place. This app is ideal for those who want to take a holistic approach to their financial management.

5. EveryDollar

EveryDollar, created by financial expert Dave Ramsey, follows a zero-based budgeting approach. It helps you allocate every dollar of your income to various categories, ensuring that you have a plan for every cent. The app also offers financial coaching and personalized advice to help you stay on track and achieve your financial goals.

Goodbudget is perfect for couples and families who want to manage their finances together. It uses the envelope budgeting method, where you allocate funds to specific categories and spend only what’s available in each envelope. Goodbudget syncs across multiple devices, ensuring everyone is on the same page.

Wally is a simple yet powerful budgeting app that focuses on expense tracking. It allows you to take photos of your receipts and categorize expenses effortlessly. Wally also offers insights into your spending patterns, helping you make informed decisions.

Clarity Money offers an AI-powered approach to budgeting. It analyzes your spending habits and offers suggestions on how to save money. The app also helps you cancel unwanted subscriptions and track your credit score.

Simplifi by Quicken is designed for those who want a streamlined budgeting experience. It categorizes transactions, tracks bills, and provides insights into your spending. The app’s dashboard offers a quick overview of your financial health.

Honeydue is a budgeting app built for couples. It allows partners to manage their finances together, track shared expenses, and set financial goals as a team. The app promotes transparency and open communication about money matters.

Wallet is a versatile budgeting app that offers expense tracking, budget planning, and bill reminders. It also includes features like currency conversion and receipt scanning. Wallet’s clean interface makes it easy to manage your finances efficiently.

Expensify is primarily designed for business expenses, making it a top choice for freelancers and entrepreneurs. It simplifies expense reporting, tracks mileage, and facilitates easy reimbursement. While it’s not a traditional personal budgeting app, it can be valuable for those who need to manage work-related expenses.

BudgetBakers offers a comprehensive budgeting experience with features like expense tracking, bill reminders, and customizable categories. It provides detailed reports and insights into your financial habits, helping you make informed decisions.

Dollarbird takes a unique calendar-based approach to budgeting. You input your income and expenses directly into a calendar, allowing you to visualize your financial future. It’s an excellent choice for those who prefer a visual representation of their finances.

Banktivity is a robust personal finance app that offers budgeting, investment tracking, and bill management. It’s ideal for individuals who want a comprehensive solution for managing their financial lives.

FAQs

In conclusion, these budgeting apps cater to a wide range of financial needs and preferences. Whether you’re a beginner looking for simplicity or an experienced budgeter wanting advanced features, there’s an app on this list for you. By using one of these top budgeting apps, you can take control of your finances, work towards your financial goals, and achieve greater financial peace of mind.

Free Invoice Template for Excel: Streamline Your Billing Process

In the fast-paced world of business, efficiency and accuracy in billing are paramount. At SaveSaga,…

20+ Budget-Friendly Gift Ideas for Every Special Occasion

Unlock the secret to heartfelt gifting without breaking the bank. Explore our guide for creative,…

30+ Ways to Make $1000 Fast in 2024: Legal, Legit, and Lucrative

#MAKE MONEY Make $1000 fast Are you struggling to make ends meet? Do you need…

How to Create a Budget as a College Student, 13 best ways

In the whirlwind of college life, Budget as a College Students can be a daunting…

8 Proactive Strategies On How To Protect From Inflation For Financial Stability

Explore proactive budgeting and investment strategies on how to protect from inflation and to maintain…

Decoding Fixed And Variable Expenses: Achieving Financial Stability Through Smart Budgeting

Master the art of financial stability with our guide on budgeting. Explore the balance between…

Pingback: 10 Brilliant Money-Saving Tips: How to Save Money Monthly

BDSY

Pingback: Mastering Your Money: The Ultimate Guide to Budgeting Success

Pingback: Traveling on a Budget: 8 Tips for Affordable Adventures -

Pingback: Unlocking the Psychological Benefits of Budgeting: Boost Financial Confidence -